ADA Price Prediction: Bullish Outlook Supported by Technicals and Fundamental Catalysts

#ADA

- Technical Strength: MACD bullish divergence and Bollinger Band support suggest underlying momentum despite current price levels

- ETF Catalyst: Grayscale's Cardano ETF advancement with SEC decision pending creates near-term upside potential

- Fundamental Innovation: Leios scaling proposal addresses network scalability concerns, enhancing long-term viability

ADA Price Prediction

Technical Analysis: ADA Shows Bullish Momentum Despite Current Dip

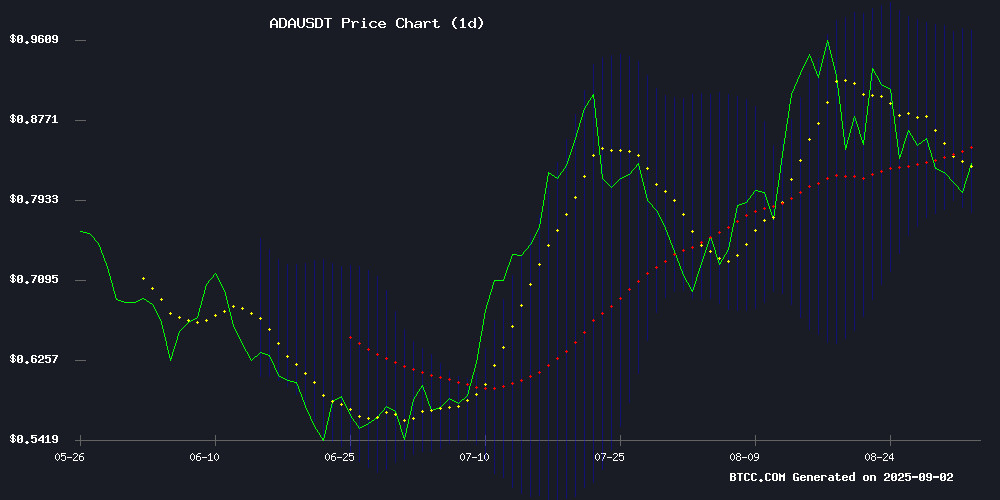

ADA is currently trading at $0.8185, below its 20-day moving average of $0.8751, indicating short-term weakness. However, the MACD reading of 0.032465 shows bullish momentum as it remains above the signal line. The Bollinger Bands position suggests ADA is testing lower support levels, which could present a buying opportunity if the $0.7784 support holds.

According to BTCC financial analyst Sophia, 'The technical indicators suggest ADA is consolidating within a range. The MACD positive divergence indicates underlying strength, while the current price sitting NEAR the lower Bollinger Band often precedes upward movements in bullish markets.'

Market Sentiment: Positive Catalysts Drive ADA Optimism

Recent developments including Grayscale's Cardano ETF advancement and Charles Hoskinson's Leios scaling proposal have created strong positive sentiment around ADA. The SEC decision deadline on the ETF application adds a potential near-term catalyst, while institutional interest continues to grow.

BTCC financial analyst Sophia notes, 'The combination of regulatory progress and technological innovation creates a compelling narrative for ADA. The ETF speculation alone could drive significant price appreciation, while the scaling solutions address long-term viability concerns.'

Factors Influencing ADA's Price

Grayscale Advances Cardano ETF Bid as SEC Decision Deadline Looms

Grayscale Investments has filed an S-1 registration statement with the SEC for its proposed Cardano Trust ETF (GADA), marking a critical step toward potential approval. The submission details operational mechanics of the ADA-backed fund, complementing February's 19b-4 application. Market participants now assign 87% approval odds ahead of the October 26 regulatory deadline, up 11 percentage points this week.

The MOVE coincides with anticipated passage of the CLARITY Act, legislation poised to unlock institutional capital by providing regulatory certainty for digital assets. Bloomberg analysts maintain a more conservative 75% approval probability, though Grayscale's comprehensive filings suggest confidence in a favorable outcome.

Cardano Price Prediction: ADA Latest Forecasts For Q4 Of 2025

Cardano (ADA) enters Q4 2025 at a pivotal juncture, with traders balancing institutional interest against prolonged consolidation. The ADA price today clings to critical support levels, hinting at a potential breakout toward $1.30 or higher. Analysts point to a descending wedge formation—a historically bullish pattern—as momentum indicators like RSI flash oversold signals.

Institutional catalysts are mounting. Grayscale's rumored cardano ETF filing and strengthening network fundamentals could propel ADA into the altcoin rally's forefront. A breach above $0.94 may trigger a 120% surge to $1.80, while failure to hold $0.75 risks a retreat to $0.32. The market watches for confirmation of either scenario.

ADA Price Set for 40% Rally Amid Critical Support Test and ETF Speculation

Cardano's ADA has shed over 10% in two weeks, yet analysts see potential for a 40% surge to $1.20 if key resistance at $0.88 breaks. Grayscale's updated spot ADA ETF filing shows 87% approval odds by year-end, injecting institutional credibility into the narrative.

Market observers remain divided. Ali Martinez forecasts $1.20 upon breakout confirmation, echoing his earlier $1.30 prediction. LSTRADER maintains bullishness contingent on ADA holding $0.82-$0.83 support. Meanwhile, Cardano advocate Dan Gambardello criticizes the Cardano Foundation for "failing the ecosystem" through lack of stablecoin development and enterprise partnerships.

Cardano Founder Unveils Ambitious Scaling Plan with Leios Proposal

Charles Hoskinson has outlined Cardano's most aggressive scaling roadmap to date, anchored by the newly proposed Leios system. The Cardano Improvement Proposal promises a 30x to 65x throughput increase within 12-18 months while maintaining the blockchain's Core UTXO model.

"We're shifting from consensus-bound to network-bound limitations," Hoskinson declared during his August 31 AMA. The staged implementation will initially prioritize deliverability over perfection, accepting marginally higher transaction latency (40-60 seconds vs current 20 seconds) for dramatic throughput gains.

This technical leap represents Cardano's continued evolution beyond its academic roots toward practical scalability. The compressed development timeline—contrasting sharply with traditional multi-year blockchain upgrade cycles—signals growing maturity in LAYER 1 innovation.

Is ADA a good investment?

Based on current technical indicators and market developments, ADA presents a compelling investment opportunity. The current price of $0.8185 offers an attractive entry point below the 20-day moving average, while positive MACD momentum and strong fundamental catalysts suggest potential upside.

| Indicator | Current Value | Signal |

|---|---|---|

| Current Price | $0.8185 | Below MA - Potential Buy |

| 20-day MA | $0.8751 | Resistance Level |

| MACD | 0.032465 | Bullish Momentum |

| Bollinger Lower | $0.7784 | Strong Support |

| Potential Rally | 40%+ | Upside Target |

The combination of technical support levels, positive momentum indicators, and fundamental catalysts including ETF developments and scaling innovations creates a favorable risk-reward profile for medium to long-term investors.